|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

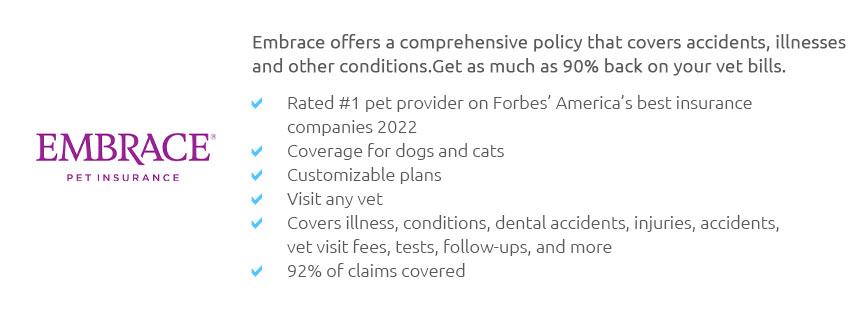

What is the Best Insurance for Pets?As a pet owner, your furry friend is not just an animal; they are a cherished member of your family. Thus, ensuring their health and safety becomes paramount. One of the most effective ways to safeguard your pet's well-being is through pet insurance. However, with myriad options available, choosing the best insurance for pets can be an overwhelming task. Understanding Pet Insurance: Pet insurance is essentially a health insurance policy for your pet, designed to cover veterinary expenses related to illness, injury, and sometimes routine care. Just like with human health insurance, there are various types of coverage plans to suit different needs and budgets. The best insurance for pets depends largely on your pet's specific requirements, your financial capacity, and your risk tolerance. Factors to Consider: When deciding on the best insurance for your pet, several factors come into play. Firstly, consider the age and breed of your pet, as some breeds may be predisposed to certain health conditions, which can influence the type of coverage you might need. For instance, larger breeds often face joint issues, whereas smaller breeds might encounter dental problems more frequently. Another critical aspect is the coverage level; while some plans cover only accidents and illnesses, others might include wellness visits, vaccinations, and even behavioral therapy. Cost vs. Benefit: Cost is a significant consideration for most pet owners. While comprehensive plans with low deductibles and high reimbursements might seem attractive, they are often accompanied by higher premiums. It's essential to evaluate whether the benefits offered justify the cost. Opting for a plan with a reasonable premium that still provides adequate coverage can often be the best approach, ensuring peace of mind without straining your finances. Top Recommendations: Some of the best insurance providers have earned their reputation through reliable service and comprehensive coverage options. Healthy Paws, for instance, is renowned for its straightforward plans and excellent customer service, while Embrace offers customizable policies that can be tailored to your pet's needs. Trupanion is another favorite, known for its direct vet payment option, which can significantly ease financial strain during emergencies. Subtle Opinions: In my experience, the best insurance for pets is one that balances cost with coverage. An insurance plan that is too expensive may not be sustainable, while one that is too cheap might not cover essential treatments. Additionally, opting for a provider with a user-friendly claims process and excellent customer reviews can make a significant difference in your overall satisfaction. In conclusion, choosing the best insurance for pets involves a thorough assessment of your pet's needs, the coverage options available, and your financial situation. Taking the time to compare different plans and understanding what each one offers can ensure that you select the most suitable insurance policy for your beloved pet. FAQ

https://www.usnews.com/insurance/pet-insurance

Pumpkin is the best pet insurance overall, according to our research. Lemonade offers the lowest average rates in our study making it a good option for pet ... https://www.aflac.com/individuals/products/pet-insurance.aspx

Pet Insurance. Aflac and Trupanion have teamed up to provide top-rated insurance coverage1 for your pets when they need it most. https://www.usnews.com/insurance/pet-insurance/pets-best-vs-spot

Which pet insurer is best for you and your pet? We compared companies to help you in your search. Read our report to learn about how Pets ...

|